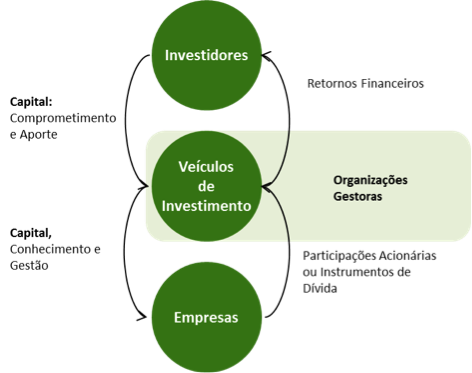

Also known as venture capital, VC/PE is an activity in which investors, acting through funds or their own investment vehicles, inject capital into companies in exchange for an equity stake. During the period in which the investor remains invested in the company (monitoring period), the aim is to add value to the company beyond the capital itself. This type of investment is known as smart-money, that is, it is not just money injected into the company, but a combination of capital and assistance in the strategy and management of the company. Later, the fund gets rid of these securities and exits the operation, always with the objective of generating a return for its shareholders.

In Brazil, these funds are constituted as Fundos de Investimento em Participação (FIP) or Fundos Mútuos de Investimento em Empresas Emergentes (FMIEE) and are regulated by the Comissão de Valores Mobiliários (CVM) through instructions 391/03 and 209/94, respectively.

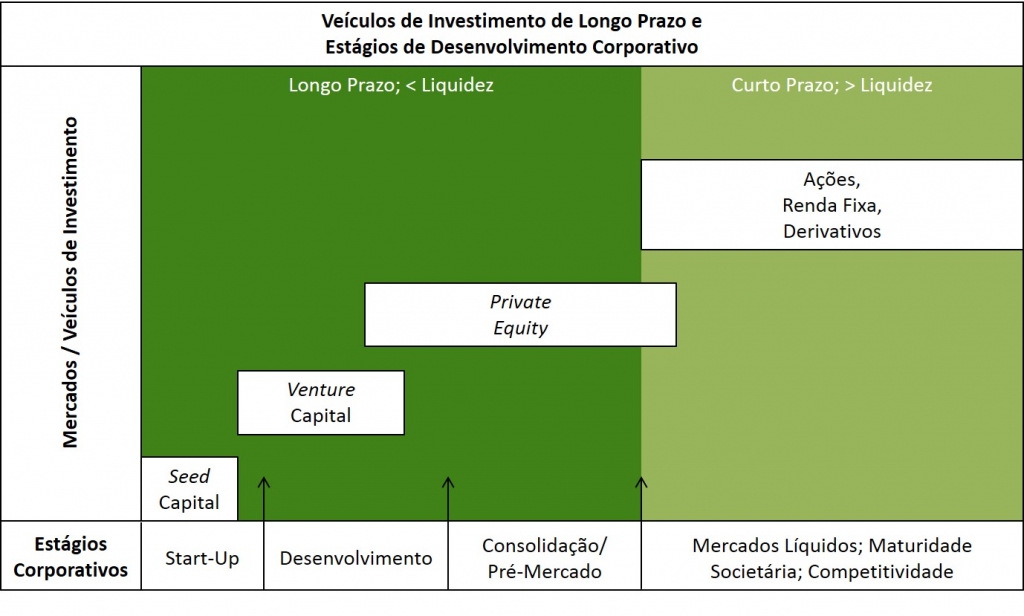

Between the two modalities, VC and PE differ mainly in terms of the stage of the companies that seek to invest.

Venture Capital is a type of investment focused on emerging companies. In general, these are companies with smaller revenues (some funds even consider companies in the pre-operational stage), but with great growth potential.

Private Equity is a type of investment that focuses on companies that are already consolidated. Generally, these are investments that also seek to accelerate the growth of investee companies that are at a more advanced stage of maturity than VC investments.

How do VC/PE funds generate value for investee companies?

Unlike other investment modalities where investors allocate resources in the desired asset and passively monitor its performance, PE/VC managers usually actively monitor their investments, directly influencing the progress and management of the invested companies. Therefore, in addition to the injection of capital, value creation occurs through strategic support and by promoting improvements in the management and corporate governance of the investee companies.

In this context, VC/PE funds are important for national economic development. By adding value to both investors and companies, such funds represent an opportunity to increase the efficiency and productivity of the Brazilian economy.

How do VC/PE funds exit investment?

Traditionally, VC/PE funds exit investee companies in four ways:

- Strategic sale to other companies in the same industry(trade sale)

- Structure of repurchase of the fund’s participation by the company itself or controlling shareholders (repurchase structure)

- Sale of participation to other VC/PE Funds(secondary sale)

- Going Public(IPO)

Where does the Capital to be invested in VC/PE come from?

The resources of VC/PE funds come mostly from institutional investors (such as pension funds, insurance companies, development institutions, innovation agencies, family offices, and fund of funds). Traditionally, the manager itself also invests its own resources in its VC/PE funds.

What is the expected profitability of a VC/PE fund?

There is no consensus and there are several studies on the subject. A good article we read recently on the subject was a study conducted by the manager Spectra Investiments in partnership with Insper researchers that found an average gross annual return of 22% in dollar terms. This study considered 46 funds that raised capital between 1990 and 2008. To access the study Click Here.

It is important to always note that past profitability is no guarantee of future profitability.

Can I be an investor in a VC/PE fund ?

VC/PE funds are financial products typically aimed at qualified institutional investors.

If you or the organization you represent fit the profile of a qualified investor and would like to know more about FIP Venture Brasil Central, please contact us: contato@cedrocapital.com

How are VC/PE funds differentiated?

VC/PE funds have different strategies that are aligned with the vocation and expertise of each manager.

For example, there are funds that only invest in companies in which they have a controlling interest. Other funds, on the other hand, seek minority stakes backed by shareholders’ agreements. There are also funds that only turnaround companies in financial difficulties, in short, there is a diversity of funds and strategies.

Cedro Capital was born with the mission of being the main manager of structured funds in the central region of Brazil (Midwest, Triângulo Mineiro, Northwest of MG and South of Tocantins). Our investment strategy is based on acquiring influential minority stakes, always backed by a shareholders’ agreement, owning no more than forty-nine percent (49%) of the capital stock of the companies to be invested in. With a team of professionals with a solid background and proven experience in the Brazilian capital market, we have the necessary expertise to create value in the invested companies.

Why should a company seek this form of investment?

There are several reasons that may make VC/PE the most attractive way for companies to finance their growth.

For many, especially emerging companies, VC may be the only alternative for significant funding to enable them to execute their strategy. Companies at this stage usually do not have the size necessary to access traditional banking lines, and the available capital of the partners is also not sufficient to promote the growth of the company.

Other companies may be large enough to access traditional banking lines, but prefer more flexible financing, for example by issuing new shares to be acquired by a VC/PE fund. VC/PE investors focus on long-term returns and assume the risk of operating the company from the original partners.

Companies should see in a VC/PE fund the figure of a new partner, but with an institutional and professionalizing character. VC/PE funds are usually managed by professionals with experience in corporate management and can assist the investee companies in negotiating contracts with suppliers/customers, in merger and acquisition processes, in hiring new qualified professionals, and in implementing good corporate governance practices, among others.

How does the investment of a VC/PE fund work?

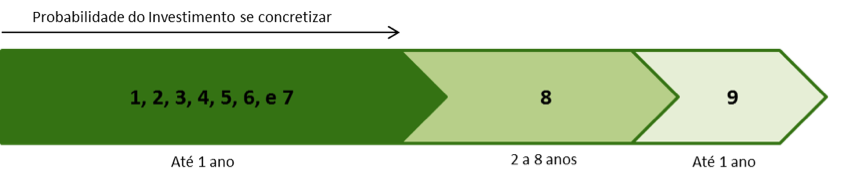

The process from the first contact between the company and the fund to the realization of the investment is a long one and requires a considerable expenditure of time and energy on both sides. Therefore, we recommend that businessmen and entrepreneurs make sure that the company is suitable to receive this type of investment and that there really is alignment between the company and the proposal of the VC/PE fund.

- Origination – Company identification by the fund and first contact with partner(s)

- Analysis – The company provides the fund with information so that the fund can analyze its business model, competitive attributes, market, balance sheet, team, among others. The goal in this phase is to decrease the asymmetry of information between the company and the fund.

- Pricing – Based on the analysis, the fund makes an economic-financial evaluation of the company’s value.

- Negotiation – In this phase the company and the fund reach an agreement regarding the value of the company and the terms of the operation.

- Investment Committee Analysis – In case the fund has an investment committee, this committee deliberates the approval of the operation.

- Due-Diligence – After the Investment Committee’s approval, the fund then conducts an audit process in the target company in order to ascertain possible contingencies and analyze issues such as corporate, contractual, and litigation aspects, among others.

- Investment and Documentation – With a positive outcome of the due-diligence, the investment is completed and the fund/company enters into an Investment Agreement and a new Shareholders Agreement.

Note: Equity Investment Funds can only hold shares, debentures, subscription warrants, or other securities convertible or exchangeable into shares issued by Corporations. Therefore, if the company is set up as a Limited Liability Company, during the process it is necessary for the company to become a Corporation.

- Monitoring – During the period, the fund monitors the company’s performance and puts its value creation strategy into practice.

- Divestment – The fund sells its shares and/or other securities convertible or exchangeable into shares of the invested company, returning capital to the shareholders.

What are the disadvantages of a VC/PE investment?

Despite being a growing investment modality in Brazil and with a differentiated value proposition, VC/PE will not always be the best way for a company to finance itself. The most common disadvantages that tend to worry business owners and entrepreneurs are the following:

- Dilution of the original partner(s)

- Loss of control of the company

- Need to account to the fund in decisions/increased internal bureaucracy

- Time and effort required to realize the investment

Such disadvantages can be mitigated in the following ways:

- Dilution of the original partner(s) is something that will occur in the vast majority of VC/PE investments and that entrepreneurs/entrepreneurs have to be okay with from the first moment they decide to pursue a fund. The original partner(s) must consider the value of the company, the stake they are willing to give up, and the need for investment, and then seek a proposal that makes sense. The logic that should be followed by the entrepreneur is that a smaller slice of a larger cake can be much better for the entrepreneur/entrepreneur than a larger slice of a smaller cake.

- There are clauses that guarantee an equivalent position in several matters, and they must be negotiated in a way that reflects the interests of both parties. These are clauses such as: drag along (obligation to sell together), tag along (right to sell together), guaranteed buyback, preferences in case of liquidation, among others.

- At the same time that the fund evaluates the company, the original partner(s) should evaluate the VC/PE fund, focusing on aspects such as: its value proposition, requirements, obligations, and corporate culture. Funds that do not require control of the company necessarily believe in the potential of the team behind the operation and are unlikely to add bureaucratic barriers to smooth decision-making. The fund should be seen as a new partner, and the best partnerships are always those where there is a clear alignment of interests among all partners.

- The investment process of a VC/PE fund is long and requires a firm commitment from both parties to bring it to fruition. Business owners/entrepreneurs can dramatically reduce the time spent during all the initial steps if they seek to understand the fund’s requirements and prepare the company and all the necessary information quickly. All critical issues and deal-breakers should be presented in the background at the initial start of the process for the purpose of optimizing the time of both parties.

What options exist for companies and projects that are not yet large enough to receive VC/PE investments?

It has never been as easy and cheap to undertake as it is today. Several innovations that have occurred in the last decade allow entrepreneurs to use sophisticated applications over the Internet, hire programmers and designers at low cost, and more.

In addition, several Brazilian organizations offer support to start-ups in different ways. Organizations such as SEBRAE offer management support services, incubators and coworks offer mentoring and/or a space for companies to work for free or at a low cost.

Accelerators form another type of organization, which in addition to acting as mentors and assisting in business development, may also make an initial investment in the accelerated companies. The Start-Up Brasil program, an initiative of the Ministry of Science, Technology and Innovation (MCTI) since 2012 offers a platform to connect and finance accelerators and selected companies.

Crowdfunding is another available option that has recently arrived on the Brazilian market. Through online platforms, companies can finance themselves by accessing various individual investors or by pre-selling products. Examples of these platforms in Brazil are Broota, Catarse, and Kickante.

Where can I find more information and learn more about VC/PE and the industry ecosystem?

Some additional features we recommend:

Materials from ABVCAP and ABDI:

How Does the Private Equity, Seed and Venture Capital Industry Work? – Basic guide to how the VC/PE industry works.

Basic documentation on operating with Participation Funds in Brazil – Basic guide on legal-contractual aspects of the industry.

How Much is My Business Worth? – Overview of economic-financial valuation methods.

Books:

– Finances

- “Finance for Executives”, Gabriel Hawawini and Claude Viallet

- “Financial Management,” Ross Westerfield Jaffe

- “The Logic of the Black Swan”, Nassim Nicholas Taleb

– Entrepreneurship and Business in General

- “The Art of The Start”, Guy Kawasaki

- “How to Get Ideas”, Jack Foster

- “The Founder’s Dilemmas”, Noam Wasserman

- “The Lean Startup”, Eric Ries

- “Drive – The Surprising Truth About What Motivates Us,” Daniel H. Pink

- “Good to Great” and “Great by Choice”, Jim Collins

- “Against the Gods: The Remarkable Story of Risk”, Peter L. Bernstein

- “Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm”, Eric G. Flamholtz and Yvonne Randle

Lectures / Videos:

The single biggest reason why startups succeed – Bill Gross, entrepreneur and founder of Idealab talks about how he came to the conclusion of the single most important factor for startups to succeed.

Something Ventured – Documentary that traces the historical background of the birth of the Venture Capital industry on the west coast of the United States.

Contradicting the Statistics – Lecture by Marcos Gomes, an entrepreneur from Distrito Federal and founder of boo-box, an online advertising startup that received funding from Venture Capital funds.